No state has led the energy transition like California has. While other states may have higher portions of wind in their electricity mix, at full sun the output of solar panels in California rivals that of Texas wind power. It has often been the first state in the nation to pass policies that drive the move to renewable energy and electrification, and these policies are regularly imitated elsewhere. As a result California has been a pioneer for a range of clean energy technologies.

California has also been the first to experience the challenges of the transition. The state is famous for its “duck curve,” where solar floods the grid in mid-day and forces other sources of power to ramp quickly in the evening to meet demand when the sun goes down. The responses to this and other challenges in California have taken many forms—including an emphasis on demand response and using imports and gas plants more flexibly. It has also meant a lot of batteries.

California has long been the nation’s leading market for both battery storage, and “solar plus storage” solutions. But PV Intel’s examination of the interconnection queue from California’s grid operator shows that in terms of large-scale projects, this transformation is reaching another stage. California is on the cusp of no longer being a solar market where batteries are being added—instead, it is becoming a battery market that (sometimes) includes solar.

Rapid battery growth

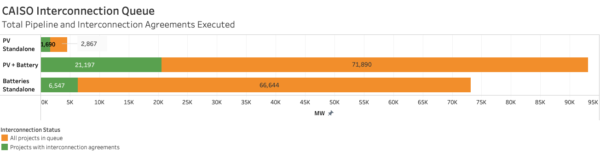

The numbers are stark: at the end of January the California Independent System Operator (CAISO) queue included a total of 282 projects with a solar component (including various hybrids of solar+storage & solar+wind), compared to 533 projects with a battery component. The raw capacities tell the same story: At 135 gigawatts (GW) the capacity of battery projects is 78% higher than the 76 GW of solar projects.

These numbers underscore the very rapid growth of battery technology in California. According to the American Clean Power Association, California had only 256 MW of utility-scale batteries before 2020, but had reached 2.1 GW by the end of 2021—an 8x increase.

In fact, few standalone solar projects are being proposed anymore. We found only 23 solar projects in the queue that don’t include batteries, meaning that more than 90% of solar projects that have applied for interconnection have a battery component.

This is in stark contrast to other grid operator queues, where solar + storage projects are still niche. The most advanced may be ISO-New England, where in January 30% of total active solar projects were paired with batteries. In Texas (ERCOT) there is also substantial battery capacity in the interconnection queue, but it is not clear how much is paired with solar.

Chocolate and Peanut Butter—or Just Peanut Butter?

When pairing generation, solar and batteries are still the main choice in California, as the “chocolate and peanut butter” combination of the energy transition. The 256 solar + storage projects representing 72 gigawatts of solar and 64 gigawatts of batteries make up the vast majority of hybrid projects in the CAISO queue, with only a handful of wind + storage or solar + wind projects.

Another notable factor is the size of the batteries. Gone are the days when small batteries were added to solar projects. The average ratio of battery capacity to solar capacity was .89. Nor are the standalone battery projects small; the average capacity of a standalone battery project in the CAISO queue is 248 MW.

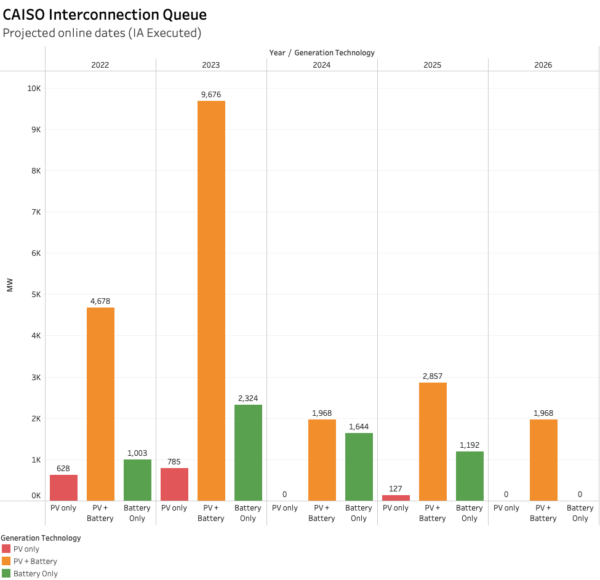

In terms of projects with interconnection agreements—a subset of projects which are more likely to be completed and to come online more quickly—solar + storage is still dominant. 76 solar + storage projects are approved for interconnection, as opposed to 31 standalone battery projects.

But the large majority of this capacity is scheduled to come online in 2022 and 2023. This means that with new projects getting approved, as early as 2024 the market could flip to standalone battery projects being dominant.

The Era of the Battery

This is not to imply that all the energy storage projects that will be built are batteries. Notably there is a 500 MW pumped hydroelectric project in California that has an interconnection agreement and is scheduled to come online in 2028; the long-term plans of California utilities show 1 GW of “long-duration storage,” which implications that this will be pumped hydro.

But the capacities of pumped hydro and other novel storage technologies planned are dwarfed by batteries, with lithium-ion continuing to dominate the market. And as a recent solicitation by California’s community choice aggregators shows, lithium-ion batteries are even being chosen for long-duration storage needs.

California will need all the energy storage it can get its hands on; a recent analysis suggests that the state needs 37 GW of batteries over the next 20 years, as well as 53.2 GW of utility-scale solar. But the projects that are being planned put the state well on its way; as 23.5 GW of large-scale battery projects already have interconnection agreements. The next few years will see whether or not California’s battery market can overcome supply chain challenges and stand on its own. But the path forward is clear. In California, the energy transition has entered a new era: the era of the battery.

Jason O’Leary, Principal Analyst at pv-intel.com, contributed to this article with data analysis and data visualization.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Surely someone has discussed the futility of attempting to STORE enough energy to power our nation. How many packages of AA batteries are laying around YOUR house?

California is where there is the biggest differences in pricing throughout the day. Batteries can be installed relatively quickly. Batteries are also a relatively safe investment because they are easier to move in the future to where there are now larger time of day pricing differences.

I would expect that over the longer term for large scale projects to limit the amount of battery storage in California as they can store power at lower cost than batteries. Also, transmission line projects could increase the ability to sell excess solar and buy wind power with other regions.

Though, those large scale projects take longer to plan, get approvals and build.

Now that is what I call important information. Thanks, Christian.

I don’t understand your article. How can a battery replace solar? What is the source of power?

Terra Power is clean, carbon free power, in a small package.

When discussing battery storage, surely the units need to be ‘GWh’, not ‘GW’. The GW number presumably tells us the peak, instantaneous amount of power the battery can supply, but it doesn’t tell us for how long. Is ‘GWh’ (GigaWatt/hour) not used by the industry and if not, how does one assess ‘for how long’?